Medigap

Let’s start with some basic definitions.

Medicare: Also called “Original Medicare”, this is the US Government’s healthcare plan for all Americans over the age of 65.

Medicare has three parts:

- Medicare Part A covers hospital visits

- Medicare Part B covers doctor’s visits, medical procedures, and medical equipment

- Medicare Part D covers prescription drugs

While this list sounds like comprehensive coverage for all your medical concerns, Medicare can, unfortunately, leave you with significant out-of-pocket costs due to high deductibles, large co-payments, and limits on coverage.

Private insurance plans can fill the coverage gaps in Medicare in order to lower your out-of-pocket expenses. There are two different types of private insurance for senior Americans:

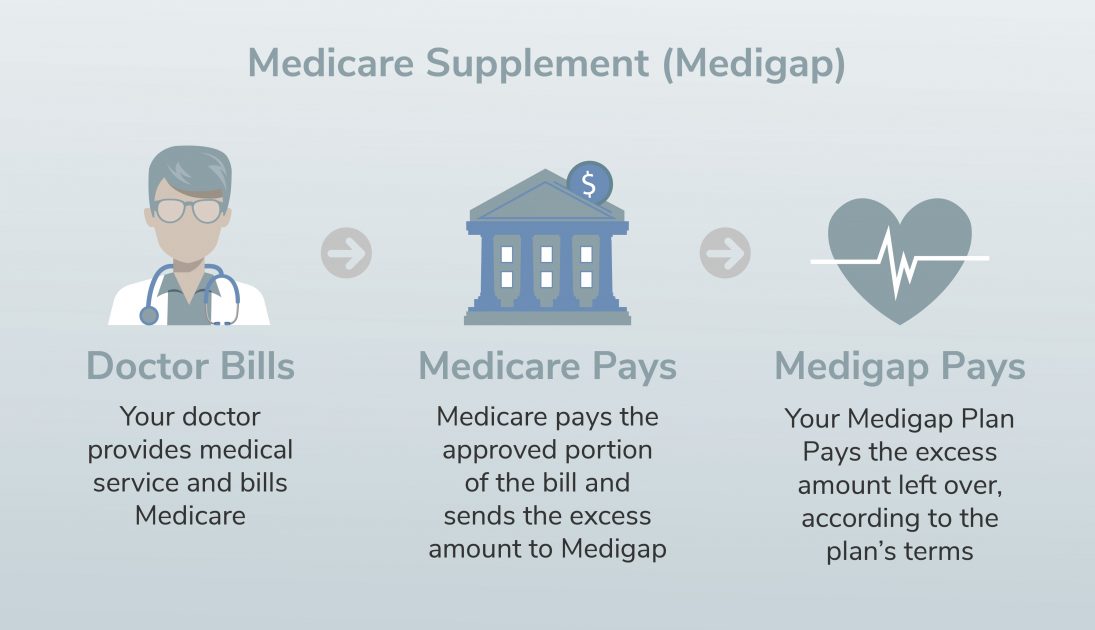

Medicare Supplemental Insurance: Also called “Medigap” insurance, this type of private insurance policy can be purchased in addition to Medicare Plans A and B. It offers additional coverage that can minimize those out-of-pocket expenses caused by gaps in your Medicare plan.

Medigap insurance is not a stand-alone policy. You must be enrolled in Medicare Plans A and B in order to be eligible for Medigap Insurance. And because most Medigap plans do not cover prescription drugs, it is also highly recommended that you are also enrolled in Medicare Plan D.

Medicare Advantage (Part C): Medicare Advantage can be purchased as a stand-alone health insurance policy if you are over 65 (you are still eligible for Medicare coverage even if you purchase a Medicare Advantage plan). Like Medicare Plans A and B, Medicare Advantage covers hospital costs, doctor’s visits, and medical procedures, and some plans may cover prescription drugs (like Plan D).

It is important to note that you cannot purchase both a Medicare Supplemental Insurance policy and a Medicare Advantage Plan. These two types of insurance are mutually exclusive. In fact, it is illegal for an insurance company to sell you both types of plans at the same time.

Benefits of Purchasing Medicare Supplement Insurance

Because Medigap Insurance is designed to supplement federal insurance, the basic benefits offered by all Medical Supplement Insurance are standardized by the federal government. Therefore, regardless of the company selling the Medigap policy, it must include features such as:

- Medicare Part A coinsurance and hospital costs up to one year (365 days) after you have used your Medicare benefits

- Medicare Part A hospice/respite care copayments and coinsurance costs

- Medicare Part B coinsurance and copayment costs

- Costs of blood transfusions up to three pints

Additionally, your Medical Supplemental Insurance must offer:

- Your choice of doctors and specialists as long as they accept Medicare patients

- Visits to specialists without referrals (also as long as they accept Medicare patients)

- Choice of different Medigap plans

- Coverage that travels with you within the US (especially important for seniors who winter in the warmer Southern states)

- Guaranteed coverage for life (although rates may change)

Depending on the specific Medicare Supplemental Insurance policy that you choose, you may also enjoy additional benefits such as:

- Coverage of Part A and Part B deductibles up to set coverage limits

- Coverage of coinsurance or copayments for skilled nursing facilities

- Coverage for medical emergencies while traveling outside the United States up to set coverage limits

As you consider which Medigap policy to choose, you will need to weigh the benefits of each plan with the costs. The monthly premium and out-of-pocket costs will vary depending on the benefits you select.

How to Buy a Medicare Supplement Insurance Policy?

Once you are enrolled in Medicare Parts A and B, you are eligible to purchase a Medicare Supplement Insurance policy. An independent insurance broker can help you compare all of the different Medigap policies available in your area and help you understand the benefits and costs of each so you select the right coverage to fit your needs and your budget. He or she can also help you navigate the Open Enrollment windows to ensure that you don’t miss out on critical eligibility windows and cost savings options.

So don’t want until you are sick to get the health coverage you need. Talk to your independent insurance agency today about how Medical Supplement Insurance can give you the additional coverage you need.

Need Help to Review Your Insurance? Contact Us.

Contact SunGate Insurance Agency today learn more about the type of insurance you need. Click here to contact us or call (407) 878-7979.

SunGate Insurance Agency Coverage

Home Insurance, Auto Insurance, Health Insurance, Group Insurance, Property Insurance, RV Insurance, Renters Insurance, Event Insurance, Insurance Bonds, Life Insurance, Business Insurance, Workers Comp, Flood Insurance, Umbrella Insurance and more!

Located in Lake Mary, Florida (serving clients Nationwide and locally in Orlando, Maitland, Heathrow, Longwood, Windermere, Kissimmee, Orange County, Seminole County and surrounding Central Florida areas.